It’s been a huge couple of weeks and a lot has changed in regards to the stimulus measures put in place by the federal government.

Firstly, here’s what hasn’t changed:

- ATO Extensions & PAYG Instalments

- Increasing the instant asset write off to $150,000

- Accelerated depreciation

- Apprentice and Trainee Wage Subsidy

- Direct Payments to Individuals of $750

Revisit our previous correspondence on these measures here.

Now, what’s changed & what’s new:

Cash Flow Boost for Employers

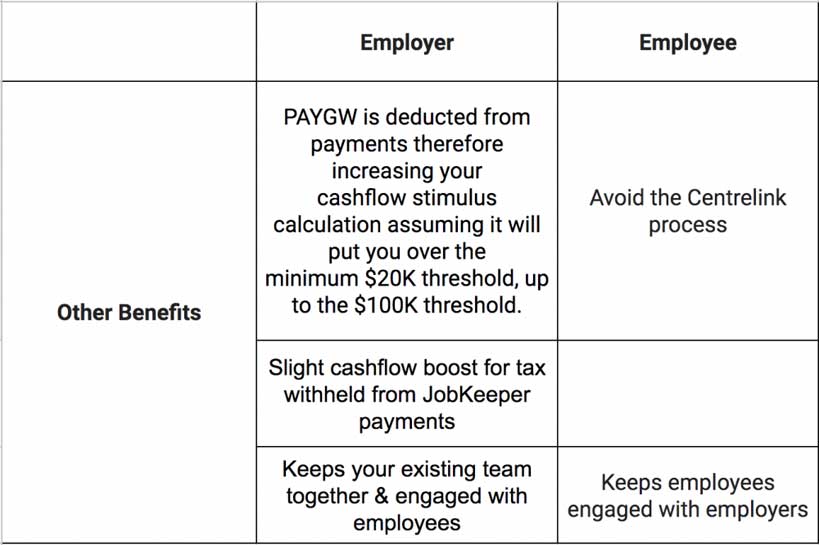

What was previously a $2,000 minimum for all employing entities is now a $20,000 minimum. The maximum cash flow boost is now $100,000, up from $25,000.

The exact calculations for how much you’ll receive & when are complex and depend on a few variables – if you’d like to know exactly what you’re likely to receive & when then please contact us directly.

“Payments” will still be delivered via credits on your ATO integrated client account and will first be used to offset any outstanding debts.

Income Support for Individuals

An additional $550 per fortnight “Coronavirus Supplement” on top of existing & new recipients of JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit.

Introducing the JobKeeper Payment

The JobKeeper payment is a $1,500 per fortnight per employee payment to eligible businesses to subsidise continuing to pay your employees. The aim of this payment is to help you maintain your existing staff and pick up where you left off (as best you can) when this crisis is over.

Who’s eligible?

Let’s assume everyone reading this is turning over less that $1 Billion dollars per year and you’re not a major bank:

- your turnover will be reduced by more than 30 percent relative to a comparable period a year ago of at least a month.

- the employer must have been in an employment relationship with eligible employees as at the 1st of March 2020.

What is an “eligible employee”?

- Full-time or Part-time employees (including those that have been stood down or re-hired) and were employed by the employer as at 1 March 2020.

- Long term, regular casual employees for longer that 12 months as at 1 March 2020.

- Over 16 years old, Australian Citizen or hold of other Visas (please refer to the attached fact sheet).

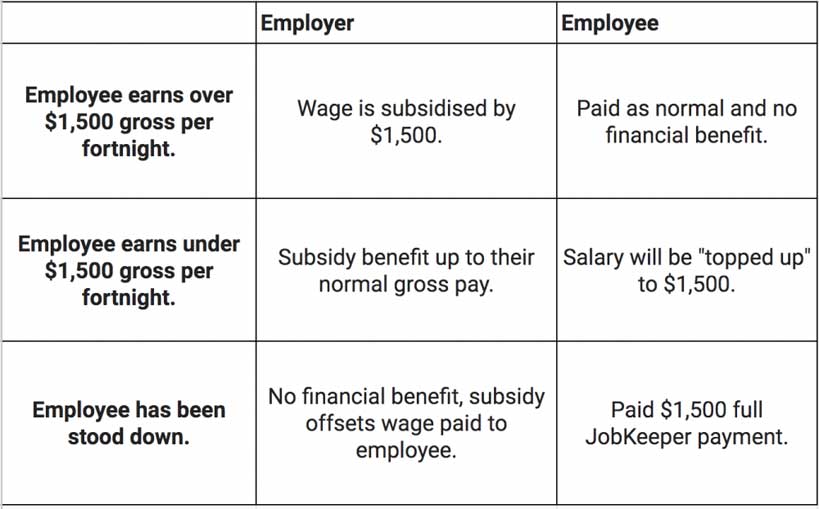

Who benefits from this and how?

Assuming your business & employees have ticked off the above criteria:

It’s important to note…

$1,500 payment is more than any combination of JobSeeker + Coronavirus supplement payment you could receive and is not subject to the income or asset limits that the JobSeeker payment is subject to.

In short, your employees will be better off under this arrangement. They should still consider their individual circumstances.

Employees can not receive both payments and must notify Services Australia that they are receiving the JobKeeper Payment as income.

Employers must notify employees that they are going to receive the JobKeeper Payment.

What, when & how do we get paid?

Payments will commence in the first week of May but will be be paid retrospectively from 30 March 2020 for a period of 6 months. Payments will be made directly into the bank account registered with the ATO for all activity statement refunds.

We can only assume that businesses are expected to be able to fund from cash flow payroll between now & when payments commence coming through from the government. This will likely present an issue for many businesses who have been forced to shut entirely.

What should you do now?

Please start by assessing the eligibility of your business.

If you believe your business will be eligible you can register your interest for the JobKeeper payment now.

Get in Touch

If you would like to discuss your individual circumstances please contact us. We’re here to help you through this difficult time.